If you are buying your first home, getting your head around home loan terminology can be tricky.

Two acronyms you may come across are loan-to-value ratios (LVR) and debt-to-income ratios (DTI). Recently there have been important changes to DTI ratios that could affect your borrowing capacity.

Here, we’ll run through what these terms mean and how they could affect you as a borrower.

What is Loan-to-Value Ratio (LVR)?

In simple terms, the loan-to-value ratio (LVR) is the amount you’re borrowing, represented as a percentage of the property’s value (as assessed by the lender). The bigger your deposit, the lower the LVR.

Here’s an example. Let’s say you’re borrowing $450,000 and the cost of the property is $600,000.

Why is LVR important?

Lenders will take into consideration the LVR when assessing your loan application. Different lenders have different maximum LVR limits – generally they consider LVRs of above 80% to be riskier.

What if my LVR is more than 80%?

You may need to pay Lenders’ Mortgage Insurance (LMI) if your LVR is more than 80%. LMI can be paid upfront or added to your home loan.

The amount of LMI will depend on the lender, where you borrow and the size of your deposit.

Bottom line: if you save a bigger deposit, you can avoid paying LMI and put that cash to use on other costs associated with the property purchase.

What is Debt-to-Income Ratio (DTI)?

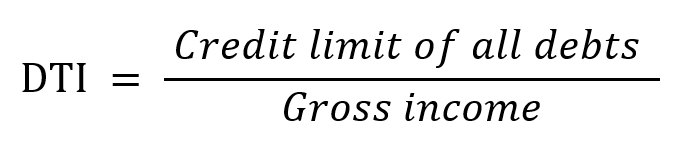

Debt-to-income ratio (DTI) is one of the ways lenders assess your ability to repay a loan.

It’s defined as the ratio of the credit limit of all debts held by the borrower, to the borrower’s gross income.

The credit limit of all debts includes:

- Mortgages

- Personal loans

- Credit cards

- Consumer finance

- Margin lending

- Buy now pay later debt (from September, 2022)

- Higher Education Loan Program (HELP) or Higher Education Contribution Scheme (HECS) debt (from September, 2022)

- Any other debts held by the borrower to any party.

Say you wanted to take out a mortgage of $400,000, and you and your partner had combined gross earnings of $160,000, plus a credit card with a monthly limit of $2,000.

Essentially your total debt would be 2.51 times your total income – which would be acceptable to most lenders.

Generally speaking, DTIs of over six times a borrower’s income are considered higher risk.

What were the recent changes to DTIs?

Against the backdrop of rising interest rates, earlier this year some of the major banks adjusted their DTI ratio limits to curb higher-risk lending .

Meanwhile, the Australian Prudential Regulation Authority (APRA) has been on a mission to rein in risky home loans to highly indebted customers for some time.

As part of APRA’s recent amendments to its prudential framework, lenders will have to include buy now pay later and higher education debts when reporting DTI ratios from September 2022.

What if I have a high DTI or LVR?

If you have a high DTI ratio, there may be ways we can help. We may be able to suggest different lenders or other options for you to work towards your home ownership goals.

Likewise, if your LVR is higher, we can run through how much LMI you may be up for or run through other scenarios where you don’t have to pay LMI.

Get in touch today!